School Accounting Outsourcing is a business function wherein one company hires another company for its School Accounting Services, instead of designating those tasks to their existing employees or hiring new ones. This not only reduces their overhead expenses, but also fulfils their expectations with limited resources.

What is Outsourcing School Accounting?

School Accounting is just like any other business accounting, wherein the same challenges need to be faced; like managing finances, accounting and bookkeeping, internal audits, government compliances, risk management, etc.

Since the school management has to juggle with these complex and lengthy tasks along with other responsibilities, outsourcing of school accounting comes as a pleasant solution.

With tighter budgets and large spending’s on essentials and expertise in the academic field, outsourcing Professional Bookkeeping Services, not only helps take care of all the requirements, but also helps in balancing their budgets effectively; thus reaping greater benefits.

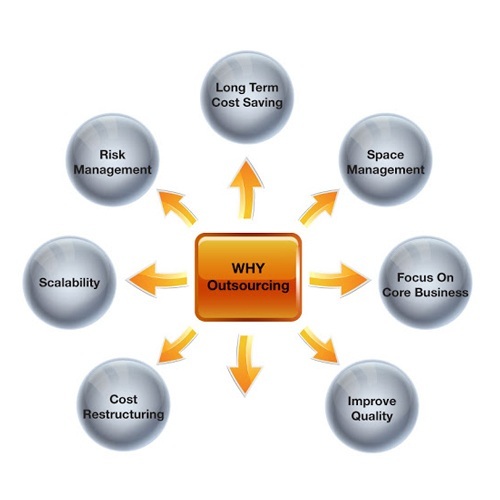

Apart from the ones mentioned above, there are many more benefits of outsourcing.

Before moving to the benefits, let’s find out the best outsourcing accounting agency of Ahmedabad. Choksi Tax Services (CTS) is undoubtedly one of the best accounting agencies, with an expert group of Chartered Accountants’ working round the clock, to fulfil the task deadlines given by their clients.

Let’s check out a few more important benefits of outsourcing the School Accounting process to CTS, and its positive impact on finances and profits.

Benefits of Outsourcing School Accounting to CTS:

1. Expert Advice Advantage:

Outsourcing accounting to another agency includes expert and skilled personnel who can give you appropriate advice related to your finances. You can take guidance from qualified Financial Analysts, Chartered Accountants’, and MBA’s, who are well versed with the latest taxation and accounting laws of the financial world via CTS. This expert advice helps you in managing your Taxation Services, accounts in a better way.

Choksi Tax Services is one such company, who offers excellent services for handling your finances, in the most cost effective way.

2. CTS helps Focus on Core Proficiencies:

One of the main reasons, why school accounting love to outsource their bookkeeping services is because, it gives ample time to focus better core proficiencies. This in turn helps in better school management.

Since the major headache of managing finances is outsourced to CTS, all the cash management tasks, finances, and investments are taken care of effectively by their company. This gives you spare time to focus on other priorities and responsibilities related to hiring teachers, conducting training sessions, setting of policies, reviewing and managing staff, preparing new curriculum etc.

3. Use of CTS Latest Technology:

Not all businesses can afford latest equipment and technology. Outsourcing of accounting process to popular firms like CTS, gives an extra advantage of use of latest technology of hardware and software. This in turn helps in maintaining accurate book keeping.

Latest scanners, servers, secured network and accurate and quick data transfers, as well as speedy services, CTS definitely plays a pivotal role in keeping you ahead of competition.

4. Cost Reduction in School Accounting:

Outsourcing accounting helps in expense reduction which is associated by hiring any new employee. These expenses include recruitment costs; infrastructure, training costs, healthcare benefits, taxes, etc.

All these expenses can be cut down when you outsource your bookkeeping to CTS, because you just need to pay for the services you hire.

Be it full outsourcing, or expert advice, Choksi Tax Services is proficient in handling your finances and firm risks, thus giving you the best out of your investment.

Schools or any other businesses can get their services at a low cost, and in a more effective way; hence they always prefer to go for outsourcing to CTS, rather than utilisation of in-house resources.

5: Scalability:

If you are thinking about cutting your expenses in terms of less workplace, electricity, office equipment, and reduction in overhead costs, outsourcing to CTS is the best solution. It helps your school accounting process to quickly scale up with their expert staff and latest technology.

6 CTS helps deal with Unexpected Circumstances:

Many times it may happen that employees of your school, succumb themselves to long working hours and huge stress and lookout for other positive prospects. Unexpected circumstances like loss of staff due to resignation, or unexpected leave of employee, can hamper your smooth functioning. It’s not always possible to take care of such unpredicted circumstances or hire additional staff for emergencies.

CTS accounting and bookkeeping agency becomes more reliable in such circumstances, wherein ample and experienced staff is always available to deliver the best results as per your expectations.

Even risk management is taken care of by them in such situations.

Example:

If your accounts manager is on an extended leave due to unavoidable circumstances, CTS will take care of your concern and provide smooth continuity and functioning of work.

7. Fulfilling Compliance Requirements through CTS:

Tax filing is a tedious and complicated process. Managing proper documentation, Accounting For Investments following deadlines and fulfilling tax compliance alongside managing other school responsibilities can become a challenge for in-house accounting and finance employees as well as school.

If taxation and book keeping are outsources to CTS, it eases this task because of its updated knowledge about taxation, tax adjustments, new tax directives, tax compliance and its positive and negative impact on your finances.

They are also efficient in tracking suspicious activities, which lead to paying of government penalties, and eliminate it by intimating the concerned authority and solving the same.

8.Increase in In-house Efficiency:

Outsourcing and Productivity go hand in hand. Productivity of your employees is bound to increase once you outsource your accounts. Now that the additional burden of taxation is passed to the outsourced firm, they can focus on their main responsibilities and projects thus improving their productivity.

9.One-Stop Destination to fulfil your Accounting Requirements:

Outsourcing is a one stop destination for fulfilling all your accounting requirements, be it expert advice, fulfilling tax compliances, seasonal workloads, critical investments and finances etc.

Example:

Choksi Tax Services (CTS) had introduced student wise accounting of fees for a particular school. The result turned out that a few parents had paid fees twice for a particular year. A refund for the same was given to those unaware parents, which increased the good will of the school as well as company.

Another school made a whopping progress from 85 students to 2200 students in a short span of 4 years. Despite absence of labour law compliances, CTS saw to it that proper Provident Fund and Professional Tax registrations were taken and timely compliance was done.

10. Security:

Security of financial data is as important as finances and hence these firms help secure your data as well. Firms like CTS, deliver mental peace since they ensure complete privacy and confidentiality of your data as well and finances, and assure you that your book keeping and Online Accounting Services In India are in safe hands.

Some More Achievements of CTS:

- Ranging from simple stationery and books purchase to purchase of costly smart boards and other IT equipment’s, CTS set up a robust vendor payment processing cycle for a particular school.

Cross check of purchase orders with final invoices and the delivery challans with the physical receipt of goods were done to maintain accurate accounts.

A stamp of received, checked & authorised was initiated where each department signed to acknowledge their part of the process.

- Suggestions regarding fixed payment processing dates and timely payments to vendors were given by CTS, which gave the school an upper hand for price negotiations.

- Labour Law compliances were done timely by this firm and hence any query from the government was eliminated.

- TDS and other income tax compliances also were done in a timely manner by CTS, thus avoiding payment of any interest or penalty.

- CTS initiated one of the clients to start 100% collection of fees by cheque and later through online mode in this current year (2020). This foresight suggested by experts of CTS, proved to be an asset during the current pandemic situation of lockdown, where in parents could pay the fees very easily, from their homes by a simple SMS click.

- With the Fee Regulatory Committee coming up, the competent accountants of CTS could submit a full proof proposal, showing perfect financial information, analysis & projections of a school, thus enabling the FRC to easily scrutinise their proposals and grant the client their proposed fees.

- One of the schools had approached CTS during FRC submission stage. Their accounting team was unable to submit the same due to incomplete accounting books.

This challenge was successfully fulfilled by CTS, who were able manage the different fee structures (English & Gujarati) of different shifts in different modes (cash & cheque); and set the accounting books straight.

Wrapping Up:

Online Bookkeeping Services is the backbone of any company and hence if it is outsourced on a timely basis specifically during tax season, it can help yield more profits.

Choksi Tax Services is one such accounting firm, wherein you can outsource your school accounting process, to secure your current as well as future accounting processes. This will also help improve productivity, efficiency and security of your school, apart from accurate book keeping.