The government introduced a new Income-tax form ITR (U) for filing the updated income tax return (ITR) in Budget 2022. To implement the concept, Section 139(8A) and Section 140B were introduced in the Income-tax Act, of 1961.

As per Income Tax laws, the due date to file ITR u/s 139(1) for FY 21-22 (AY 2022-23) was 31 July 2022. A belated return was also provisioned wherein the assesses who missed filing their IT return within the due date could file the same up to 31 December 2022.

Filing of revised returns was also permitted within this belated return deadline to rectify the errors caused while filing the original ITR.

➨ What is an Updated ITR (ITR U)?

The ITR-U form comes as a relief for taxpayers who have not filed their ITR or made erroneous/false entries while filing their income tax returns. ITR-U can be filed within two years from the end of the relevant assessment year till they update their return.

Example: For the assessment year 2021-22, an updated return can be filed by 31 March 2024 if the taxpayers have filed a wrong return or missed reporting some income.

In this form, the taxpayers should state the reason for:

-

Filing their revised IT return

-

Reason if return not filed

-

Reason for choosing the wrong income heads

-

Reason for wrongly/reduced carried forward losses

The main motto of introducing ITR (U) was to motivate taxpayers to file their returns with extended time for voluntary tax compliance and to alleviate legal consequences.

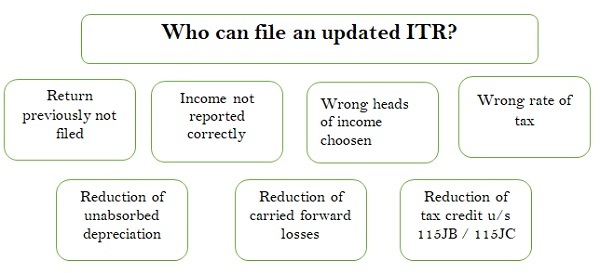

➨ Who can File ITR (U)?

A taxpayer who has either filed his ITR on time/belated/revised or not filed his ITR for the assessment year has the option to file an updated return within 2 years commencing from the end of the relevant assessment year. The ITR-U should result in additional payment of tax to the Government.

Example: An updated return cannot be filed to claim a refund of tax paid.

➨ When can an Updated Return be Filed?

An updated return can be filed when the taxpayer needs to:

-

File income tax returns of income which have not been filed previously

-

Make rectifications in the filed/disclosed tax return

-

Modify the income heads

-

Reduce the carry-forward losses

-

Reduce the unabsorbed depreciation

-

Reduce the income tax credits

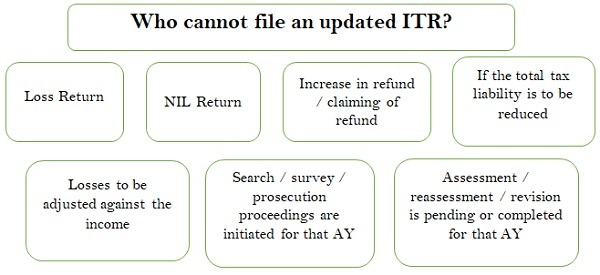

➨ When can you Not File an Updated Return?

An updated return cannot be filed under the below-stated circumstances.

-

The updated return is a return of the loss.

-

The income-tax liability is reduced in the updated return as compared to the earlier filed return.

-

The updated return result in enhancing the refund amount.

-

The search has been started under section 132.

-

Books of accounts or any other document are called for under section 132A or a survey is carried out under section 133A.

-

Any proceeding of assessment, revaluation, recalculation, or revision is pending or completed in that year.

-

The Assessing Officer (AO) has information against such person under the Prevention of Money Laundering Act or Black Money (Undisclosed Foreign Income and Assets) and Tax Act or Benami Property Transactions Act or Smugglers and Foreign Exchange Manipulation Act and the same has been communicated to the assessee.

➨ How to Calculate Tax on an Updated Return?

If No ITR is Filed:

If the taxpayer has not filed the ITR, they need to pay the tax due, the interest on the tax, and the late filing fee for the delay before filing the updated return. They also need to make the payment of the tax plus the additional tax levied on the filing of the updated return.

The tax payable is calculated after considering:

-

The amount of advance tax (already paid)

-

TDS/TCS

-

Relief of tax claimed under various sections of the Income Tax Act

-

Any AMT credit/MAT credit

If ITR is Filed:

In case the taxpayer has already filed the ITR then, the taxpayer needs to pay the tax due (including additional tax) together with interest and a late filing fee for delay in furnishing the ITR or payment of additional tax before submitting the updated return.

Note: The amount of self-assessment tax as well as the interest paid in the earlier return will be deducted from the tax payable and the tax shall be increased by the amount of refund (if any) issued in respect of the earlier filed return.

➨ How Additional Tax is Calculated for Updated Return?

A taxpayer who is filing an updated return needs to pay an additional tax of 25% or 50% of the tax amount depending on the return filing date.

The additional tax payable at the time of submitting an updated return is calculated as follows:

-

If an updated return is filed after the due date of filing a belated/revised return but before the completion of 12 months from the end of the relevant assessment year – 25% of aggregate tax (+Surcharge + Cess) and interest under section 234A/B/C (as applicable) needs to be paid.

-

If an updated return is filed after the expiry of 12 months but before the completion of 24 months from the end of the relevant assessment year – 50% of aggregate tax (+Surcharge + Cess) and interest under section 234A/B/C (as applicable) needs to be paid.

➨ How to File an Updated Return on the e-Filing Portal?

-

Login to the e-filing portal with your login credentials.

-

Click on e-File > Income Tax Return > File Income Tax Return.

-

Select the relevant assessment year and the return filing type “139(8A)-updated return”.

-

Later, select the ITR Form.

-

Upload the JSON file created offline and submit the return (The utility for the JSON file can be downloaded from the ‘downloads’ tab appearing on the Income Tax Portal).

-

The updated return (ITR-U) needs to be submitted along with an updated version of the applicable ITR form (ITR 1 – 7) wherein an earlier return was filed.

-

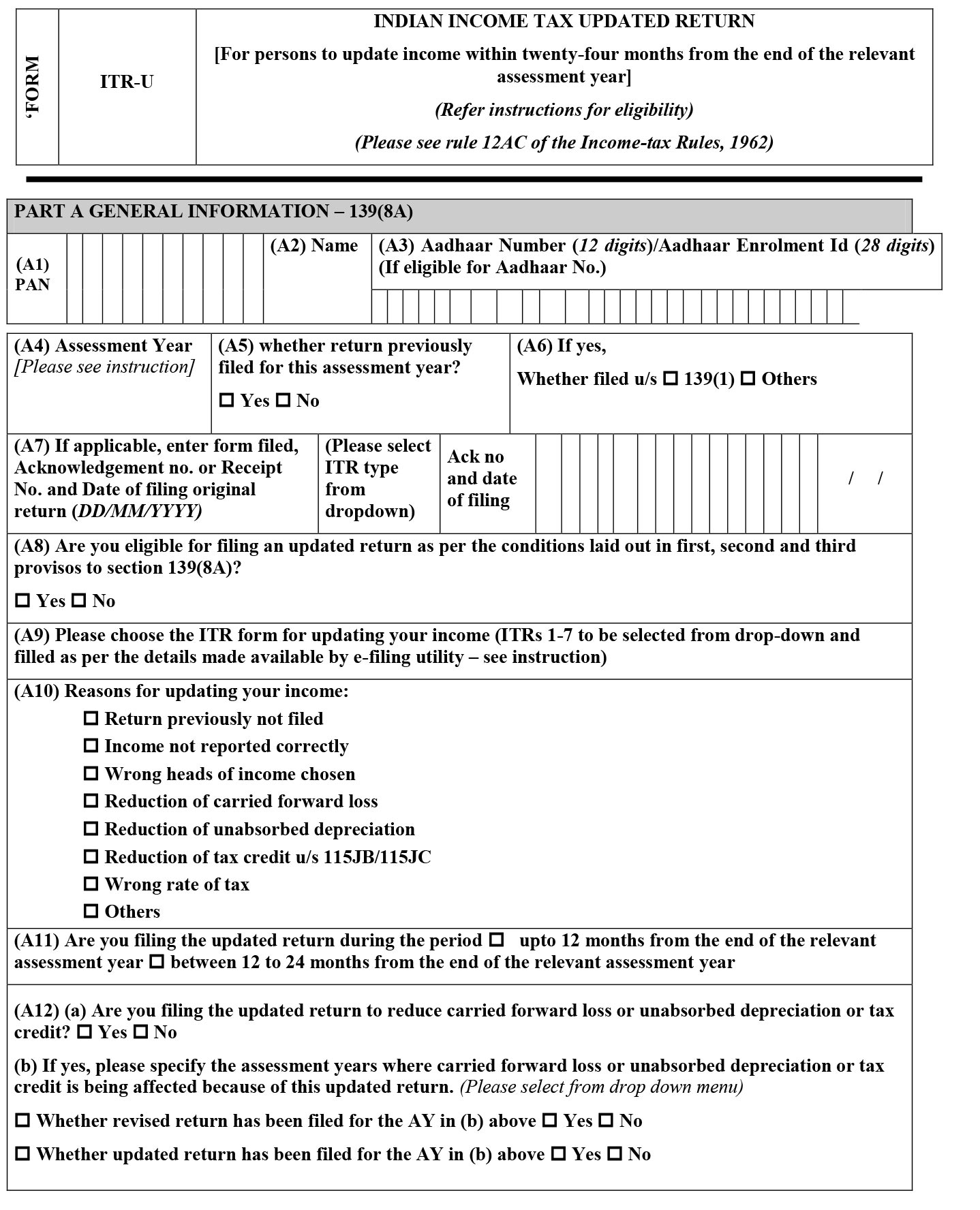

There are two parts in the updated return.

Part A – General information – 139(8A)

Here the basic details of the taxpayer need to be filled. The PAN number, Adhar number, the ITR filing date, the acknowledgment number of the original return (if any) filed, checking the eligibility criteria for filing the updated return, selecting the reason for filing an updated ITR, selecting the option whether an updated return is being filed within 12 months or 12-24 months, etc.

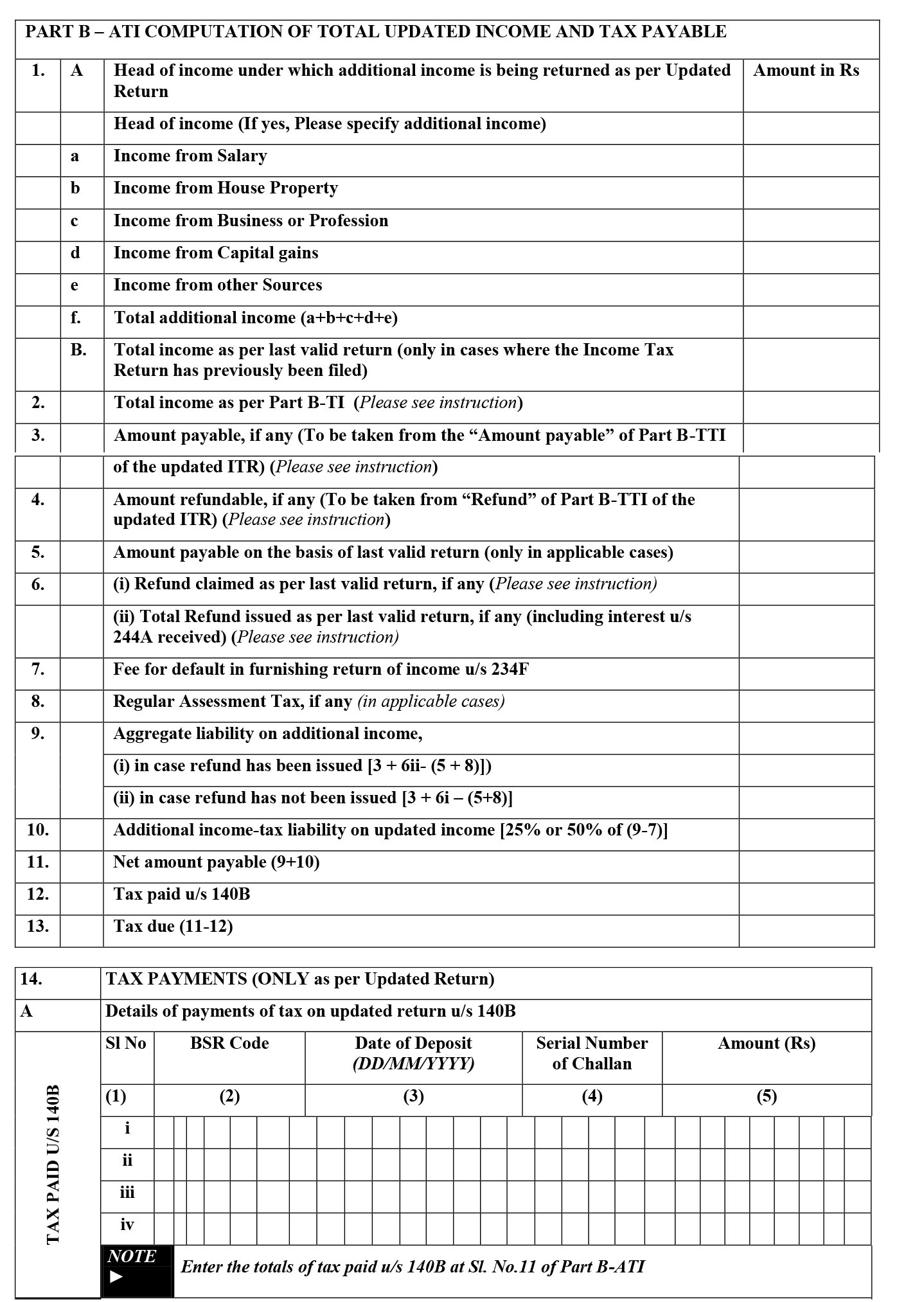

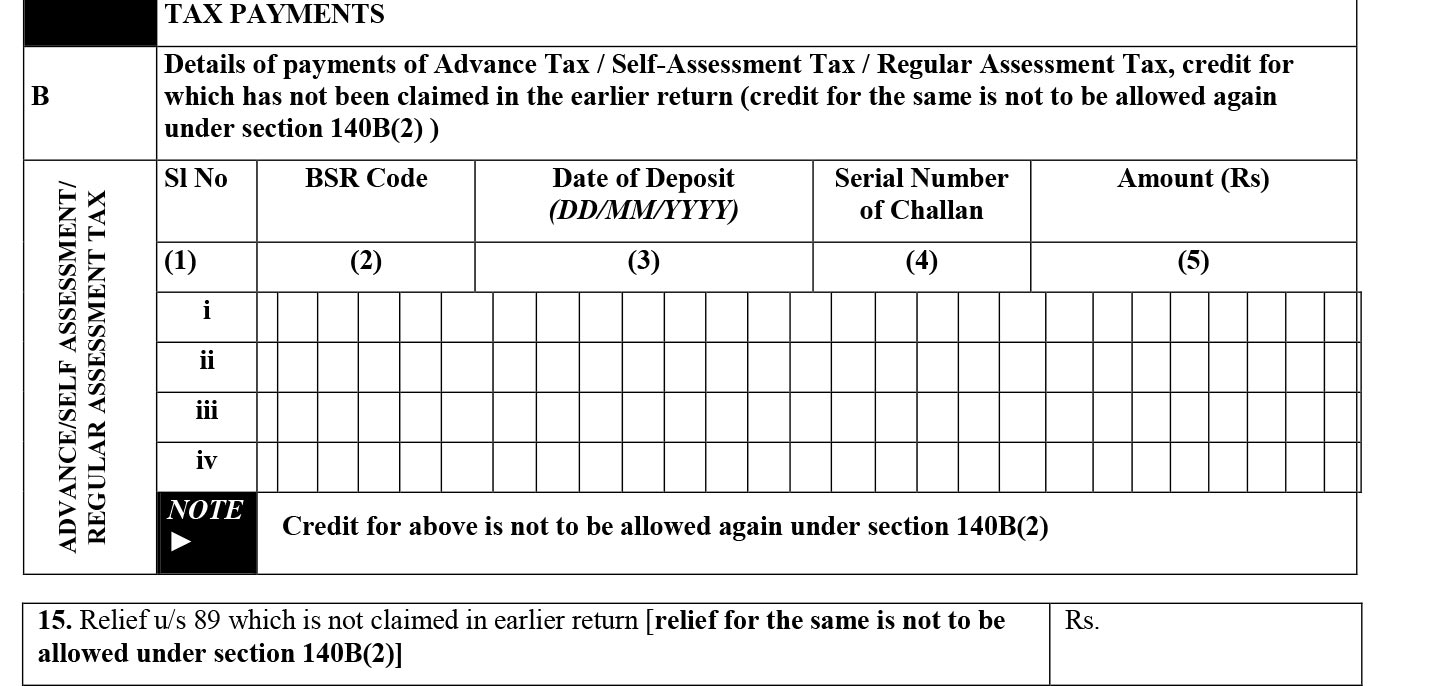

Part B – ATI Computation of Total Updated Income and Tax Payable

The basic income heads, total income, refundable amount of updated ITR, refund claimed/issued, assessment tax, aggregate liability on additional income, the tax liability on updated income, tax paid/due, etc. need to be filled in.

Finally, e-verify the updated return to complete the filing process through DSC or EVC (as applicable).

Electronic Verification Code (EVC), is given for non-tax audit cases.

Digital Signature Certificate (DSC) in tax audit cases.

Wrapping Up:

Filing updated returns is sometimes a complex process for a layman who is confused about the web of taxation and its compliances.

Approaching Choksi Tax Services (CTS) is the only remedy for such people since this company has experts and professionals who can guide you regarding the updated return form and its filing process.

Their experts offer their services and also provide detailed and transparent reporting about the ITR-U which not only helps the client in understanding the process easily but also helps in gaining their trust. So, what are you waiting for? Approach CTS for resolving all your tax issues and queries.